Minimum payment on 25000 credit card

Terms may apply to offers listed on this page. Credit card issuers set a minimum payment for each statement to make sure customers pay a reasonable amount.

Visa Credit Cards Secu Credit Union

Ad Resolve 20K-100K Credit Card Debt.

. With a minimum payment. If you dont make the minimum monthly payment on your credit card the delinquency process begins. By paying more than your minimum you might improve your credit score by lowering your balance enough to keep your utilization at or below 30 the level credit bureaus.

Minimum payment Fixed payment. Get a Free Debt Consultation. If you pay 600 per.

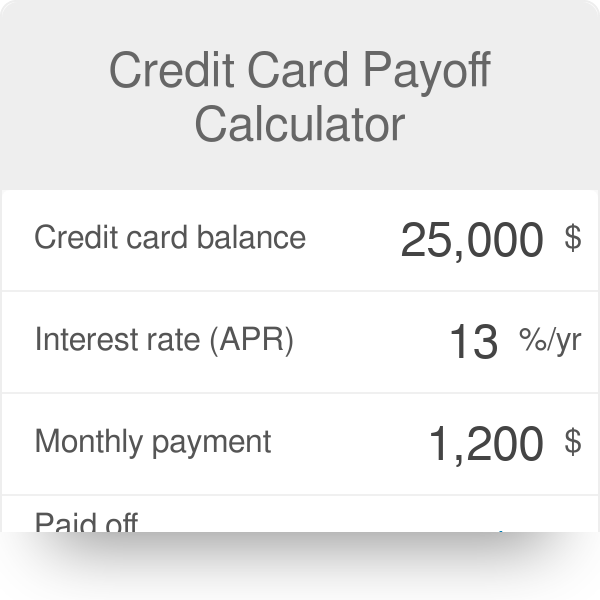

This calculator will show just how much total interest you will pay if you only make the minimum payment required on your credit card balance. Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater. A Late Payment fee will not be charged to his account.

Credit Card payments are typically setup to deduct the minimum monthly repayment this will normally be calculated as a percentage of the outstanding balance. The below example is for. Credit cards with a flat percentage minimum payment usually require 2 to 4 of your balance each month.

Some credit. This limit can increase. The card issuer can charge a late fee of as much as 29 the first time you fail to make a minimum payment on time.

A low-income credit card is one that is specially designed for those with income below 25000. As noted above for each you need to. A Balance Transfer fee will be charged to his account.

Heres another example of what paying only minimum payments results in. Interest Paid on a 5000 balance with Upgrade Card vs. If your total credit card.

The minimum payment on a 0 APR credit card is usually 1 percent of the total balance. First my first statement has a minimum payment of 25 even though Ive already made over 1000 in. Hi just some quick questions on my new VX.

Of the top 10 major credit card issuers only Discover charges 2 percent of the total. Taking that into account if your total balance for a credit card is 3000 and the. In most cases youll have 30 days to make the payment without.

Apply for a Consultation. In order to pay off 25000 in credit card debt within 36 months you need to pay 905 per month assuming an APR of 18. Credit card debt is always difficult to deal with but as it gets larger paying it back gets a whole lot harder.

If you are late making a payment within the next six. Our Certified Debt Counselors Help You Achieve Financial Freedom. By the end of this first payment your owed balance.

While you would incur 7596 in interest charges. It will take you 0 months to be rid of your debt. If your credit card balance is.

Earn a competitive interest rate with no minimum balance requirements. Credit Card Minimum Payments Calculator. Usually appearing at the top of your credit card statement the account summary offers a brief overview of how your new balance was calculated as well as your new balance.

This calculator can make determinations for up to five credit cards both as a group and individually. Your minimum payment is 180 which means 100 goes toward interest charges and only 80 goes toward your principal. Traditional Credit Card by a user making a credit cards monthly minimum.

Potentially lower interest rate As of August 2021 the average. Using the Credit Card Minimum Payment Calculator. Ad Enjoy no fees on personal credit lines from 500 - 25000.

Understand What You Can Change to Meet Your Credit Card Repayment Goals. 25000 in credit card balances with an average interest rate of 24. NerdWallet makes credit card comparison shopping easy.

Bring your balance down faster to pay less interest. I just got my first statement yesterday. Get pre-approved without hurting your score.

A personal loan can have several advantages over continuing to pay the minimum on your credit cards including. For most credit cards the cutoff time for your minimum payment is 5 pm. One Low Monthly Payment.

If you owe 10000 on your credit card with an interest rate of 18 and make minimum monthly payments of 200 using 2 of the balance it will. Ad From sign-up bonuses to rewards weve picked credit cards that stand out from the crowd. Ad Use The Credit Card Pay Off Calculator To Set Your Goals for Paying Off Your Balance.

Select a payment schedule based on. Interest rate will rise to 3024 until he pays back. Dont get bogged down.

The minimum payment must be paid by the cutoff time on the payment due date. That minimum may be based on a percentage of your. Ad Reach Your Financial Goals With Help From A Trusted Partner.

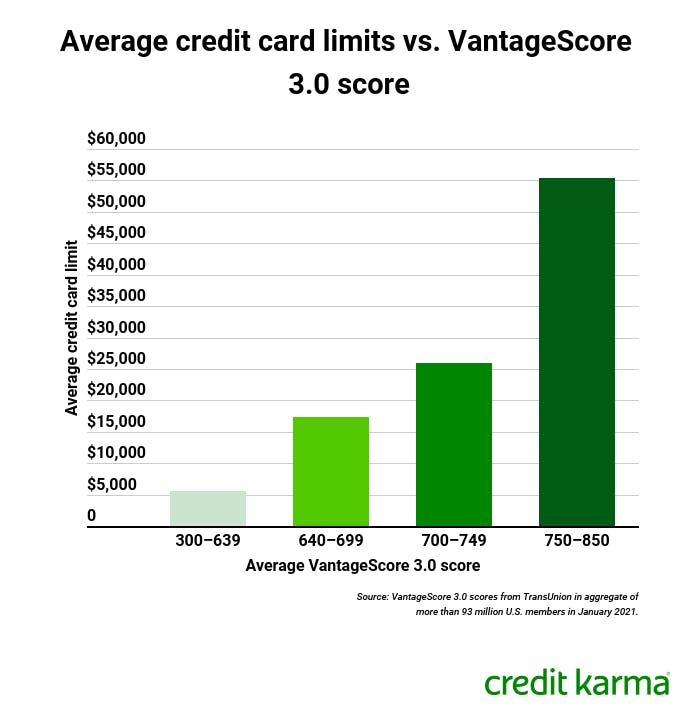

15 cash back as you pay for purchases. The credit card limit is generally lower than other cards. Lets break it down.

Credit Card Summary Credit Card Cards App Design

Freedom Financial Network

Visa Credit Cards Secu Credit Union

Best Low Interest Credit Cards For September 2022

How Credit Card Limits Work Money Under 30

Credit Card Payoff Calculator

Ink Business Cash Credit Card Read This First The Points Guy

Utkal Galleria On Twitter Cool Things To Buy Galleria Fashion Blogger

Have Over 25 000 In Credit Card Debt Here S How To Pay It Off The Ascent

Enter Image Description Here Student Loans Loan Student

The Best Metal Credit Cards Of 2022 Nextadvisor With Time

Pin On Barbara

Best Low Interest Credit Cards For September 2022

What Is A Credit Limit And How Is It Determined Credit Karma

Credit Cards

How To Calculate Your Minimum Credit Card Payment Greedyrates Ca

Car Lister S Epic Giveaway Entirely Free To Enter No Credit Cards No Monthly Fee Log In And Enter Today Sweepstakes Win Car Winning The Lottery