35+ lock mortgage rate before contract

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Youll know how much home you can afford before you go.

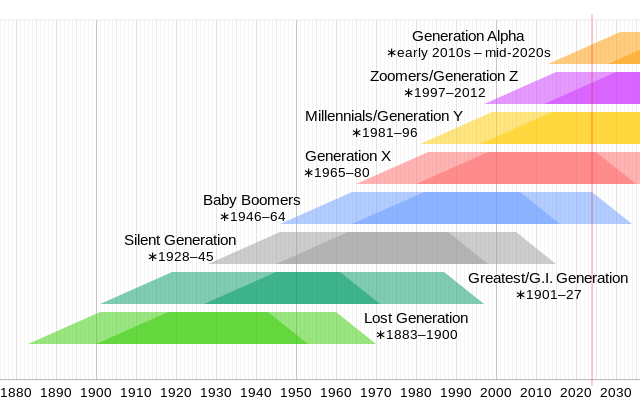

Millennials Wikipedia

Protect Yourself From a Rise in Rates.

. Protect Yourself From a Rise in Rates. Web When you choose the term of your mortgage rate lock the shorter the term the lower the rate. Web Locking in a mortgage rate protects you against rate hikes that lead to higher monthly payments and long-term costs especially during times of volatility.

For instance your lock choices might look like this for a 30-year fixed. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Lock Your Rate Now With Quicken Loans.

Ad Get More From Your Home Loan With Competitive Rates. Web Some loans require longer rate lock periods. Equal to 30-day mortgage rate - 25 basis points 0250 percent 15-day rate lock.

The longer the period is. Web 7-day rate lock. Lock Your Rate Now With Quicken Loans.

Ad Calculate Your Payment with 0 Down. If your interest rate is locked your rate wont change between when you get the rate lock and closing. Serving 4 Million Lifetime Customers.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Mortgage interest rates can change daily sometimes hourly. Web The steps to locking in your mortgage rate are very simple.

Ask your lender to lock your rate. You cant actually lock your rate in your lender must lock the rate. Ad Were Americas 1 Online Lender.

Ad Compare Best Mortgage Lenders 2023. Web Typically rate locks are only offered once you have a fully ratified sales contract. This means you wont need to worry about rates going.

Web Can you lock down a mortgage rate without going into a contract. Web Up to 25 cash back Whether buying a house or refinancing people who dont use a rate lock are at the mercy of the mortgage market while it ebbs and flows as the loan goes through. If getting a lock.

The mortgage rate will depend on a number of variables that are subject to change. Equal to 30-day mortgage rate - 125 basis points 0125. However long term rate locks can be pricey.

This is because rate locks can only be offered for a limited amount of time. Youll want to implement the lock. If you secure a rate as soon as your offer is.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. A mortgage rate lock period could be an interval of 10 30 45 or 60 days. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Web Most mortgage lenders offer you the option to lock in your mortgage rate after your loan application has been pre-approved. Web Typically 30 - 60 day locks will cost you nothing.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web However youll usually have a 45-day window for mortgage shopping. Apply Online Get Pre-Approved Today.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Mortgage rate locks last for an average of 30 to 60 days which is usually about how long it takes to close on a house.

The lender will also ask you if you want to lock in the rate or float the rate. Web Compare todays Fixed Mortgage Rates 30 20 15 and 10-year terms and find the one that fits your needs. Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days.

Ad Were Americas 1 Online Lender. If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan. Web A mortgage rate lock sometimes called rate protection is a tool that allows you to lock an interest rate in place for a set period -- typically 15 to 60 days.

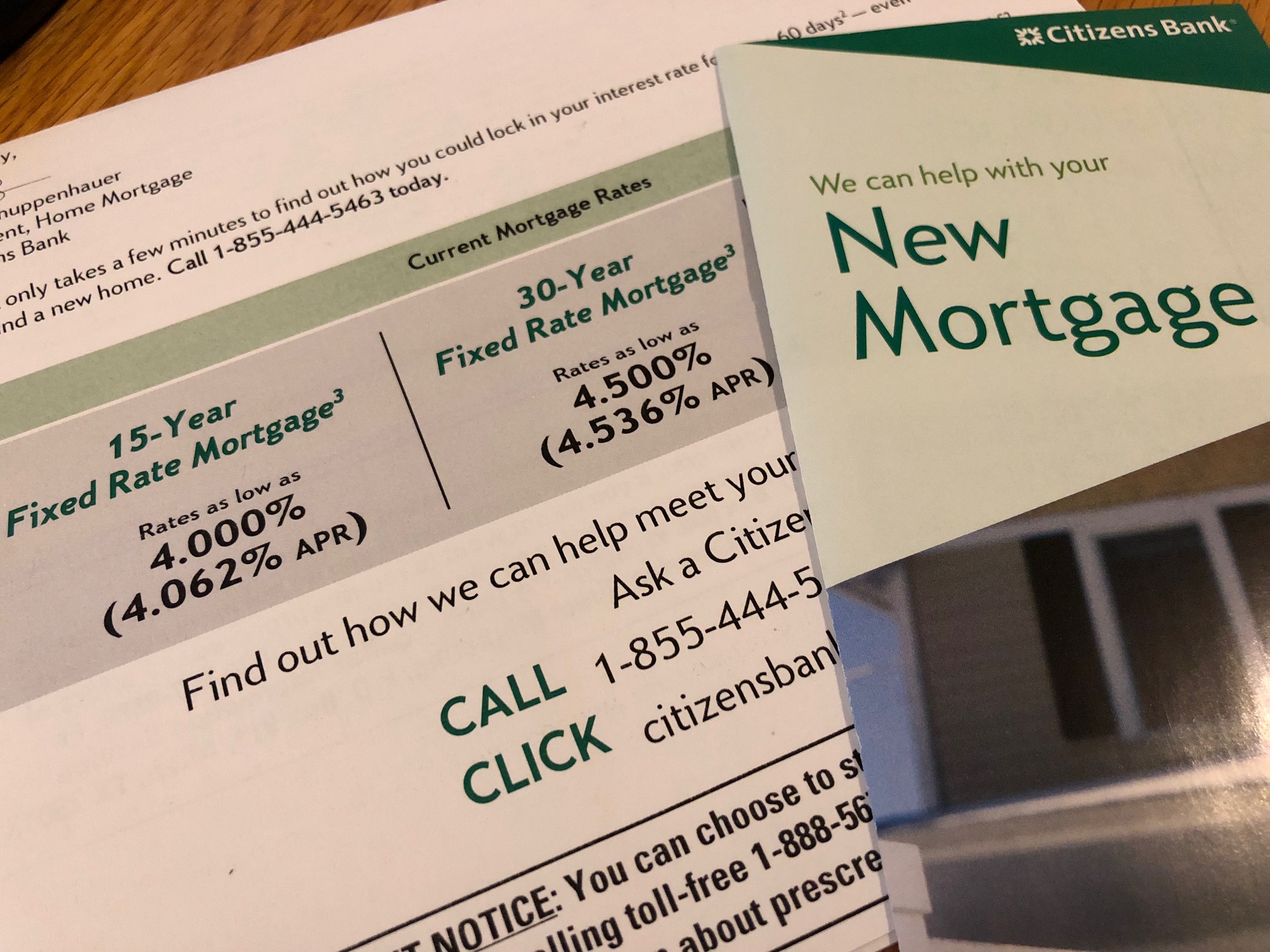

Web 15 hours agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Web A rate lock may be issued in conjunction with a loan estimate. They range from 025 - 05 of the loan amount.

Web For example if you get a 30 year mortgage with a 4 interest rate for a 300000 home and make a 20 down payment a quarter-point 025 rise in interest will increase your.

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

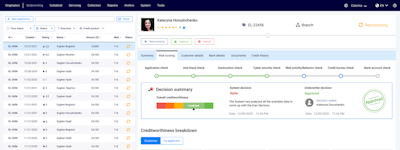

Capterra Mortgage Software Comparison Reviews Updated 2023

Capterra Loan Origination Software Comparison Reviews Updated 2023

Nj3dgm6wexnpam

Ares Initiation

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

The Week On Wall Street Dangerous Crosscurrents Nysearca Spy Seeking Alpha

Nl 081618

Today S 30 Year Mortgage Rates February 2023 Buy Or Refi

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

What Is A Rate Lock Agreement Hauseit Nyc Miami

Sarah A Colucci York Region S Mortgage Expert Savings Guaranteed Mortgage News

Should You Pay To Extend A Mortgage Rate Lock Mybanktracker

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

425

Primelending West Plains Home Facebook

Mortgage Rate Lock How An Interest Rate Lock Works